Keep it Honest

The hardest part of investing is keeping your own demons in check

A key moment in the recent AI hype reset happened on September 22, 2025, when Nvidia announced a major strategic partnership with OpenAI. The deal involves Nvidia committing up to $100 billion in progressive investments to help OpenAI deploy at least 10 gigawatts of Nvidia-powered AI systems (starting in 2026). This is essentially structured vendor financing tied to massive GPU deployments.

Before the announcement, Nvidia’s stock was trading around $177. By mid-December 2025, it remained near that level despite an initial surge and a peak above $200 in October. The market got excited at first, then quickly reassessed and pulled back.

The financing risk itself is limited and phased progressively, so that’s not the core issue. The bigger concern is that the partnership seems driven more by momentum—keeping the AI ecosystem expanding—than by a clear, independent commercial or strategic need. It feels like a bandwagon move, and Nvidia CEO Jensen Huang’s involvement heightened perceptions of potential overextension.

Similar patterns emerged in later OpenAI deals, each adding more hype and interconnected complexity. Peak frenzy was reached when OpenAI announced taking an ownership stake in Thrive Holdings (a subsidiary of Thrive Capital, already a significant OpenAI investor). Whether this web of cross-ownership in the emerging ‘OpenAI Keiretsu’ proves to be a house of cards or just some weird finance structure remains to be seen. But one can’t escape the feeling that these interlocking interests are fragile and unsustainable.

Even established players like Oracle got involved, repositioning as an AI infrastructure provider through huge commitments tied to OpenAI, including expansions under the multi-gigawatt Stargate project. Oracle’s stock jumped on the news but later retreated as the initial enthusiasm cooled.

Investors see this cycle often: A hot startup aggressively promotes itself in a booming field, fueling rapid growth on hype. Skepticism fades into fervor because, occasionally, these stories do succeed spectacularly. Every now and then, a hype-driven company becomes a trillion-dollar powerhouse—and no one wants to miss that. But most “unicorns” fail to deliver real, lasting profits for public investors. Examples include Uber, Coinbase, Airbnb, DoorDash, Lyft, WeWork, Myspace, and Netscape. Some reach IPOs where insiders cash out, but the broader market often uncovers limited underlying value.

Humans are wired to dream

Why do investors get caught up? Because humans are wired to dream big. Spotting generational winners like Amazon, Apple, or Tesla requires vision, optimism, and a tolerance for risk—you can’t always wait for ironclad data. But that’s exactly where overreach happens: fantasies start overriding facts.

There’s a classic Silicon Valley adage: “In the short run, we overestimate new technologies; in the long run, we underestimate them.”

Hype acts like dopamine—an addictive rush from visions of trillion-dollar markets. It feels exhilarating... until it doesn’t.

What’s unfolding now with OpenAI and partners like Nvidia, Oracle, and others is a healthy market correction: risks are being repriced, and the hype is deflating.

Ideally, this leads to consolidation, where more solid, reality-based companies emerge as the true AI leaders. It could temper inflated valuations (and perhaps even ease pressures on things like San Francisco real estate).

So, how can investors pursue true generational opportunities without falling into excessive dreaming?

The key: Keep It Honest.

Pause and ground your enthusiasm in reality. “Keep It Honest” means anchoring in science and proven technology trajectories. Dreaming is fine—even necessary—but it must be rooted in what’s demonstrably possible.

It’s okay to bet on massive value from something like Tesla’s Cybercab fleet if you genuinely believe it can deliver a better experience at lower cost. Or on Nvidia achieving enormous scale if its platform truly enables widespread embodied intelligence.

At Orange Capital Partners, much time is spent tracking scientific advancements—not for acclaim, but because real breakthroughs start there. Science validates concepts; technology refines them into products; commercial scaling follows predictable laws like Wright’s (costs fall with cumulative production) and Moore’s (compute doubles roughly every two years).

For transformative impact, a technology needs to offer lower costs, greater convenience, and broad demand. In a market like transportation, where demand is insatiable, lower cost and more convenience will drive value and Tesla’s Cybercab has a good chance of achieving those goals.

Keeping It Honest: The Robotics Case Study

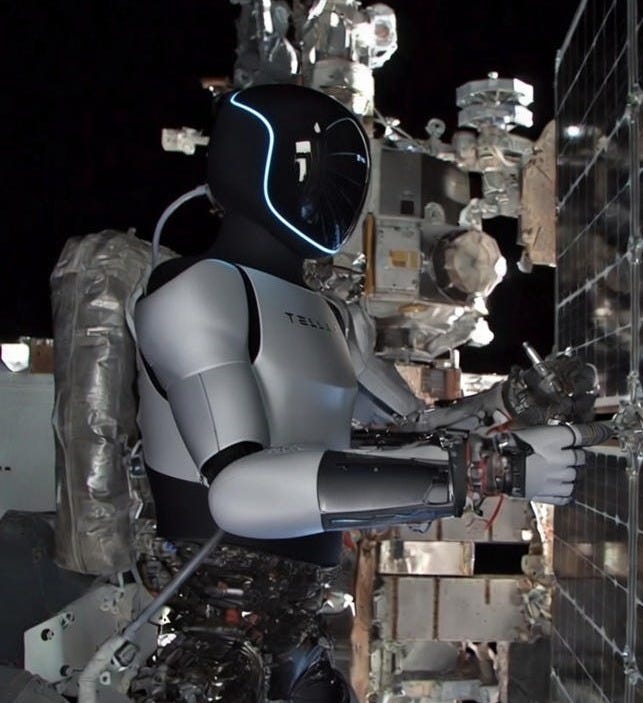

Elon Musk has long promoted Tesla’s Optimus humanoid robot, sparking hundreds of similar startups (especially in China) since Tesla’s 2023 reveal.

Is this hype or reality? Let’s keep it honest.

Start with the science: Robotics was once niche compared to software AI, but talent surged in recent years. Pioneers like Fei-Fei Li (on embodied intelligence), Sergey Levine, Pieter Abbeel (Berkeley), Dhruv Batra (Carnegie Mellon), and Dieter Fox (University of Washington), just to mention a few, drove steady advances. Key breakthroughs in multi-task learning and generalization suggests scalable robot intelligence is approaching.

When Tesla announced Optimus, the underlying science was ripe. Technology caught up quickly: China made actuators, sensors, and dexterous hands far more affordable. Robotics boils down to reliable parts, smart AI, and engineering—especially solving low-cost, durable hand manipulation and balance for real-world use.

The remaining challenge is gathering enough data for general embodied intelligence.

Two science-backed paths look promising:

World models: Building on Fei-Fei Li’s work—create realistic simulations grounded in real-world data to train robots virtually.

Continuous learning: Ideas from Richard Sutton (e.g., OAK architecture) and echoed by Levine—deploy robot fleets that improve through on-the-job experience with real data.

These provide roadmaps for scalable, intelligent robot fleets.

Energy could be the ultimate enabler (”It’s energy, stupid!”). Musk envisions Optimus constructing orbital AI data centers—leveraging abundant, cheap solar power in space without earthly constraints. Robots will build and maintain vast solar arrays and infrastructure in space, unlocking vast amounts of energy. Orbital data centers might become our generation’s equivalent of oil fields in the early 20th century. It’s a vast energy resource for Earth-based commerce. Humans can’t build mile-scale space facilities alone—robots can.

True wealth emerges when breakthrough tech meets enormous markets.

Conclusion

Keeping it honest means tethering big dreams to reality: Begin with scientific proof-of-concept, advance to engineered products, then scale affordably using laws like Wright’s and Moore’s. This framework helps distinguish genuine generational winners from fleeting hype—while remaining open to real paradigm shifts.

This piece really made me think, do you believe this 'Keiretsu' structure could gnerally foster innovation or just create a more fragile ecosystem, your insights are truly sharp.